Saving builds a foundation

The first step in investing is to secure a strong financial foundation. Start with these four basic steps:

- Create a “rainy day” reserve: Set aside enough cash to get you through an unexpected period of illness or unemployment–three to six months’ worth of living expenses is generally recommended. Because you may need to use these funds unexpectedly, you’ll generally want to put the cash in a low-risk, liquid investment.

- Pay off your debts: It may make more sense to pay off high-interest-rate debt (for example, credit card debt) before making investments that may have a lower or more uncertain return.

- Get insured: There is no better way to put your extra cash to work for you than by having adequate insurance. It’s your best protection against financial loss, so review your home, auto, health, disability, life, and other policies, and increase your coverage, if needed.

- Max out any tax-deferred retirement plans, such as 401(k)s and IRAs: Putting money in these accounts defers income taxes, which means you’ll have more money to save. Take full advantage if they are available to you.

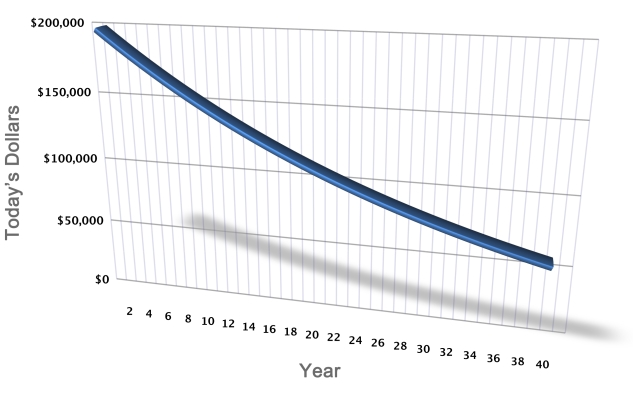

The impact of 3% yearly inflation on the purchasing power of $200,000

| IMPORTANT DISCLOSURES These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot assure the accuracy or completeness of these materials. The information in these materials may change at any time and without notice. |