There are many reasons why individuals are bound to fail in the stock market. I will explain the five most important reasons.:

- Being influenced by emotions

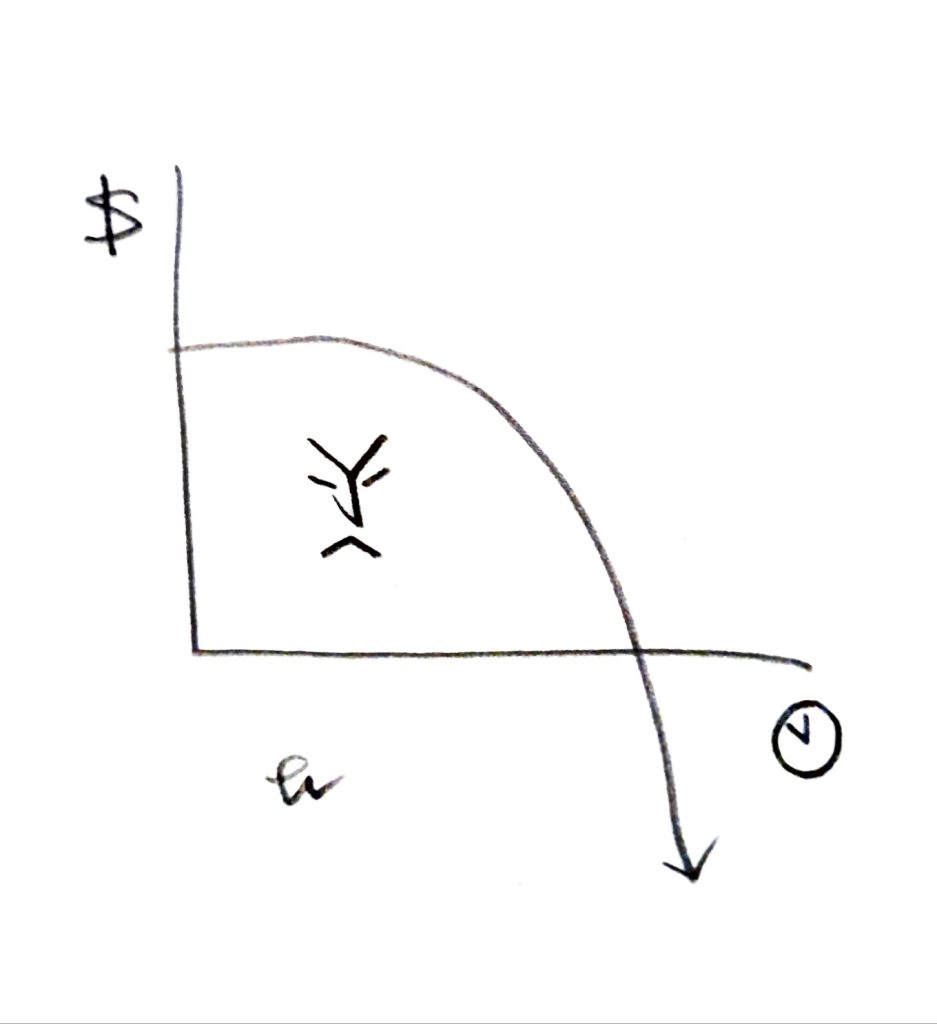

Stocks are highly volatile, so many decisions are made emotionally. For example, when the stock price falls, people sell out of fear, and when it rises, they buy in hopes that it will continue to go up. Making buy and sell decisions based on emotions increases the likelihood of being wrong and leads to failure. - Chasing short-term profits

Many people in the stock market want to make quick money in the short term. They often follow stocks that are skyrocketing or keep reinvesting after losses. However, this is mostly risky and makes it difficult to achieve sustainable profits. - Lack of information

To invest in stocks, you need sufficient information about the company and the market. However, individuals often trade without properly researching, which can lead to significant losses if the information is wrong. - Lack of diversification

Some people trade all their money in a single stock. If that stock experiences a significant drop, they will suffer major losses. Diversifying investments across multiple stocks can reduce risk, but this is often overlooked. - Failure in risk management

Risk management is crucial in stock trading. However, many people fail to consider risk before trading and continue to trade until they are unable to bear any further losses. This can lead to substantial financial crises.